-

Learn about REMICADE®

- Adult: moderately to severely active Crohn’s disease

- Pediatric: moderately to severely active Crohn's disease

- Adult: moderately to severely active ulcerative colitis

- Pediatric: moderately to severely active ulcerative colitis

- Adult: moderately to severely active rheumatoid arthritis

- Adult: active psoriatic arthritis

- Adult: active ankylosing spondylitis

- Adult: chronic severe plaque psoriasis

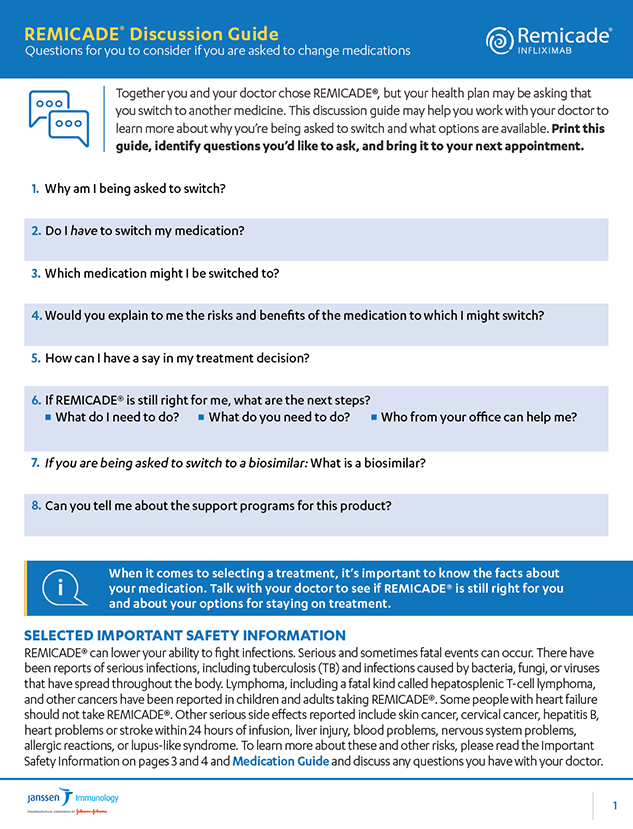

- Continuing on REMICADE®

-

The infusion process for REMICADE®

- Adult: moderately to severely active Crohn’s disease

- Pediatric: moderately to severely active Crohn's disease

- Adult: moderately to severely active ulcerative colitis

- Pediatric: moderately to severely active ulcerative colitis

- Adult: moderately to severely active rheumatoid arthritis

- Adult: active psoriatic arthritis

- Adult: active ankylosing spondylitis

- Adult: chronic severe plaque psoriasis

- Cost support & more

- Additional resources